Every week, I receive a handful of text messages that are clearly scams. Some claim I owe money for unpaid tolls. Others pretend to be from Coinbase, warning about a withdrawal code I never requested. A few even offer improbable job opportunities at companies I’ve never heard of. While these texts are annoying, spotting them has long been fairly straightforward. Clues like foreign area codes often give them away. For instance, a “job offer” text from a number beginning with +63 — the country code for the Philippines — doesn’t take long to recognize as fraud.

However, the rise of AI is changing that. Scammers are now crafting messages that read more naturally and sound more convincing. When a text vaguely references something familiar, such as a delivery issue with an Amazon purchase, it’s far easier to second-guess yourself. This kind of subtle manipulation makes it harder to distinguish a fake message from a legitimate one, especially for older adults or those less comfortable with technology. According to The Wall Street Journal, this growing sophistication has turned text scams into a billion-dollar industry over the past few years — a staggering amount for what may seem like digital junk mail.

The Numbers Game Behind Text Scams

Because many recipients can instantly spot a scam, bad actors rely on volume — sending messages to as many numbers as possible and waiting for even a few to bite. The WSJ recently reported that more than 330,000 toll road scam messages were sent to Americans in a single day last month. Across weeks and months, the numbers balloon into the hundreds of millions.

To achieve that reach, cybercriminals use “SIM farms” — large clusters of devices loaded with active SIM cards to mass-send texts. Some operate overseas, but many are based right in the U.S. According to Ben Coon of cybersecurity firm Unit221b, at least 200 SIM boxes are active across 38 locations in cities like Houston, Los Angeles, Phoenix, and Miami.

How Scammers Turn Texts Into Cash

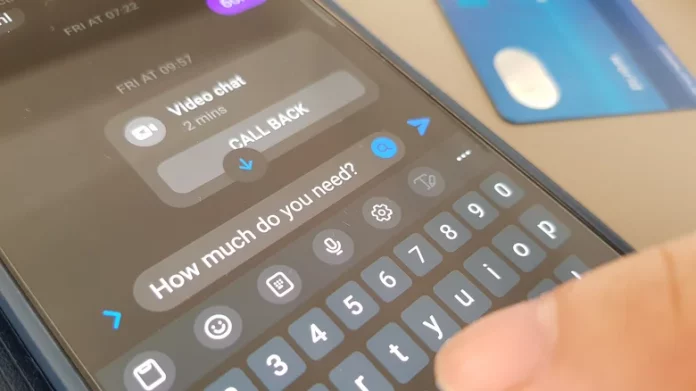

The scam model itself is deceptively simple. Each text message aims to trick users into clicking a link and entering their personal or financial information — a classic phishing technique. Once a victim provides their credit card details, the scammers can use that information to set up mobile wallets like Apple Pay. They then sell those credentials to other criminals who “max out” the cards for a small fee.

The trail doesn’t end there. Many of the purchased goods — such as gift cards, smartphones, and other high-value items — are shipped overseas, often to organized cybercrime operations in China. The result is a vast and well-coordinated ecosystem that thrives on deception and scale.

And while awareness is growing, the issue isn’t going away soon. A recent Pew Research study found that 61% of U.S. adults receive at least one scam text every week — underscoring that these messages have become a routine part of modern digital life.